Upstream

Oil and gas are produced by KMG’s operating assets and megaprojects where KMG has non-operating interests.

KMG’s key strategic objectives in terms of production are as follows:

- stabilisation of production at existing operating assets;

- commencement of production at new fields;

- gas production ramp-up;

- successful implementation of projects to expand and extend production plateau at major oil and gas projects.

Oil and gas are produced by KMG’s operating assets and megaprojects where KMG has non-operating interests.

KMG participates in three major oil and condensate production projects in Kazakhstan, with interests of 20%, 16.88% and 10% in Tengiz, Kashagan and Karachaganak, respectively.

The Company partners with the world’s oil giants to deliver on its megaprojects. These giants include Chevron, ExxonMobil, Shell, Eni, TotalEnergies, INPEX, China National Petroleum Corporation (CNPC) and LUKOIL.

Production assets

Oil production

In 2022, KMG’s total output was 22.0 mln tonnes or 456 thous. bbl per day, up 1.7% year-on-year. The share of operating projects and megaprojects in its total oil and condensate production was 63% (13.8 mln tonnes) and 37% (8.3 mln tonnes), respectively.

One of the main drivers behind a 1.7% increase in oil and condensate production in 2022 was a 9.9% production growth at Tengizchevroil following the lifting of OPEC+ restrictions, and the reliable operation of production facilities. The increase in total production was offset by a 4.4% decline at one of our operating assets, Ozenmunaigas, mainly as a result of power outages caused by the utility company servicing Ozenmunaigas’ production facilities, as well as a decline in production at mature fields.

mln tonnes

The technical characteristics of KMG’s oil differ from region to region. The heaviest oil is produced by Karazhanbasmunai (bbl/tonne conversion rate of 6.68), the lightest one – by PetroKazakhstan (bbl/tonne conversion rate of 7.75).

There are two main parameters of high-quality crude oil: high API gravity and low sulphur content. The sulphur content of the CPC Blend brand (KMG’s main megaprojects) is 0.56%, API gravity – 45.3, which makes it one of the world’s highest quality oils.

The largest gem in Kazakhstan’s oil and gas industry, a unique supergiant oil field.

KMG develops world class projects through partnerships with international oil and gas companies.

The agreement on Tengizchevroil was signed between the Republic of Kazakhstan and Chevron Corporation on 2 April 1993, with a 40-year hydrocarbon exploration and production licence granted to Tengizchevroil in 1993. Tengizchevroil focuses on the exploration, production and sales of hydrocarbons from the Tengiz and Korolevskoye fields in the Atyrau Region.

Interests

As part of production capacity expansion, TCO is implementing the Future Growth Project (FGP) and the Wellhead Pressure Management Project (WPMP), which are designed to boost oil production from the Tengiz field by 12 mln tonnes per year.

Operator | Tengizchevroil

Tengizchevroil (TCO) operates a licence that includes the unique supergiant Tengiz field and the adjacent Korolevskoye field with significant reserves. The Tengiz oil field was discovered in 1979. It is one of the world’s largest oil fields.

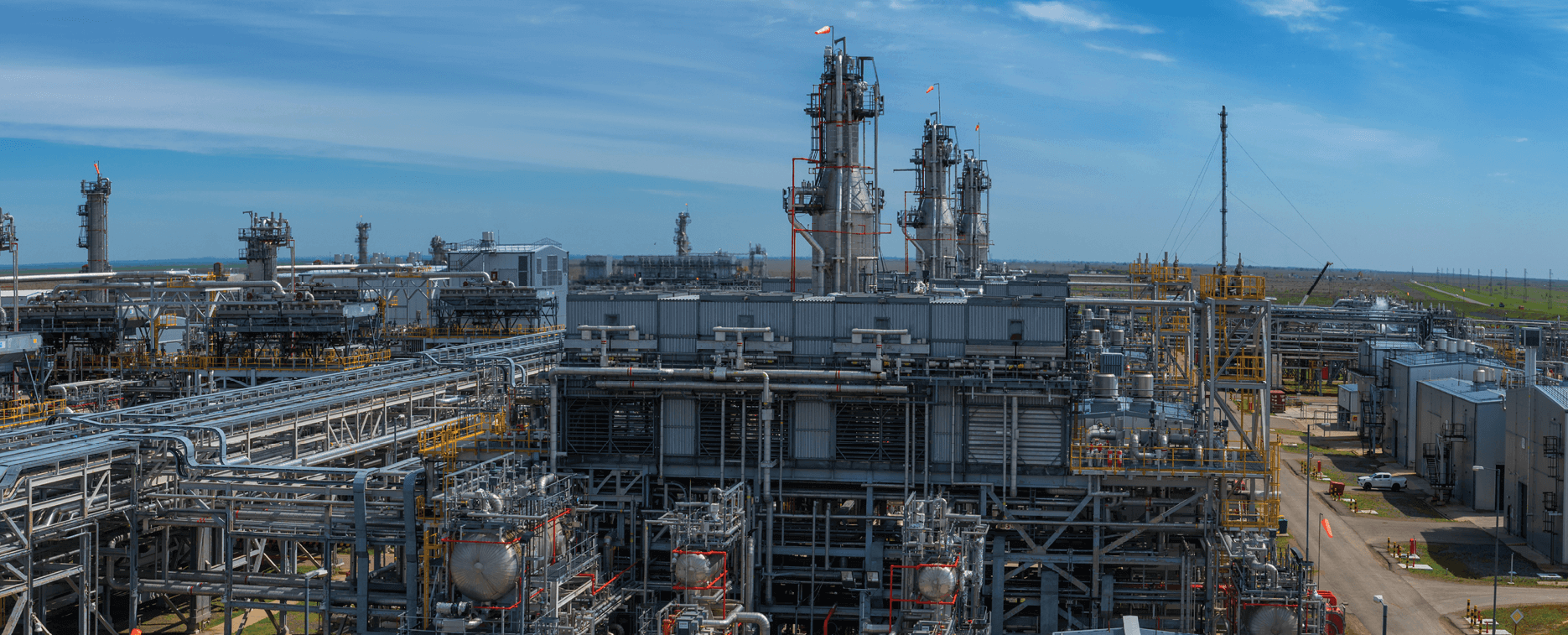

Currently, oil is produced and processed by highly reliable modern operating facilities, including complex technology lines (CTL), Second-Generation Plant (SGP) and sour gas injection unit (SGI).

In 2022, oil output increased by 9% year-on-year to 29,178 thous. tonnes (including KMG’s share of 5,836 thous. tonnes), while gas output was up 9% year-on-year to 16.15 bln m3 (including KMG’s share of 3.23 bln m3). The growth was attributable to the absence of OPEC+ restrictions in the reporting year.

mln tonnes

Tengizchevroil’s operational highlights

Progress on the Future Growth Project and the Wellhead Pressure Management Project

As part of production capacity expansion, TCO is implementing the Future Growth Project (FGP) and the Wellhead Pressure Management Project (WPMP), which are designed to boost oil production from the Tengiz field by 12 mln tonnes per year. The two projects make a significant contribution to the national economy by creating new jobs, training qualified specialists, building new production facilities and upgrading infrastructure in the region.

At the end of 2022, the total cost of FGP–WPMP was USD 42.1 bln, with the overall project progress at 96.6%. Under the updated 2022 schedule, the launch of the WPMP and FGP facilities is slated for December 2023 and June 2024, respectively.

Since the start of FGP–WPMP, TCO has spent over USD 15 bln on the procurement of domestic products, works and services. All project works related to module manufacturing, transportation and placement on foundations have been fully completed. Well drilling is also complete, and all group metering stations have been commissioned. 2022 saw the launch of the Single Centre for Production Management that will work as a one-stop shop for managing all TCO facilities under a single operating model.

bln m3

The huge Kashagan field is the largest discovery in recent four decades. Kashagan is one of the most complex projects in the industry globally.

The Production Sharing Agreement in respect of the North Caspian Sea (NCSPSA) was signed by the Republic of Kazakhstan and an international consortium in November 1997. North Caspian Operating Company N.V. is the project operator, acting on behalf of the project contractors.

Interests

Operator | North Caspian Operating Company N.V.

The North Caspian project is the first major offshore oil and gas project in Kazakhstan. It includes three fields: Kashagan, Kairan and Aktoty. The Kashagan South-West field is currently being returned to the government.

The Kashagan field lies in an offshore location 75 km from Atyrau at water depths of 3 to 4 m. The field reservoir lies at a depth of over 4 km and is characterised by high pressures (over 700 bar) and high hydrogen sulphide (H2S) concentration. At the same time, sour gas reinjection at high pressure improves oil recovery.

Kashagan is one of the most challenging industry projects globally due to harsh environmental conditions at sea and significant design, logistics and safety challenges. Located in the subarctic climate, the North Caspian Sea is covered with ice for about five months a year, requiring innovative technical solutions. KMG, together with international partners, is successfully implementing the project, having achieved sustainable production rates with further growth potential.

The Kashagan field infrastructure comprises onshore and offshore facilities. Onshore facilities include the Bolashak Onshore Processing Facility (an integrated oil and gas treatment plant) while the offshore facilities comprise a range of manmade structures including an operations and process complex on Island D, Island A, and early production islands EPC-2, EPC-3 and EPC-4. A total of 40 wells were drilled on the Kashagan field, including six injection wells, 33 production wells, and one monitoring well.

In 2022, oil and gas production from the North Caspian project stood at 12.7 mln tonnes and 7.9 bln m3, respectively. Kashagan production decreased by 22% year-on-year to 3.554 thous. tonnes of oil and 2.000 mln m3 of gas. The decline in production in 2022 was caused by scheduled midyear overhauls at the offshore and onshore facilities, as well as the need to carry out repairs after the discovery of a gas leak at the preliminary gas separation unit (slug catcher) in August. Still, oil production attributable to KMG’s share increased by 4.3% to 1.402 thous. tonnes (34 thous. bbl per day) and production of raw gas rose by 7.3% to 877 mln m3 as KMG’s share in the project grew from 8.44% to 16.88% from 15 September 2022 due to the successful completion of the share buy-back in the project from Samruk-Kazyna.

Currently, KMG (through Cooperative KazMunayGaz U.A.A wholly-owned subsidiary of KMG, with the direct ownership of 99.7440256% and indirect ownership via KMG Kumkol LLP of 0.2559744%.) owns KMG Kashagan B.V. which, in turn, has a 16.88% interest in the North Caspian project. Thus KMG indirectly owns 16.88% of the project.

Under the terms of the PSA, all oil produced at the Kashagan field is exported, including KMG’s share of the oil. The produced oil is mostly exported to Europe, East Asia and India via Novorossiysk, where the oil is delivered by the CPC pipeline.

Slug catcher incident at Kashagan

On 3 August 2022, as a gas leak was detected at the Bolashak preliminary gas separation unit (slug catcher), production at the Kashagan field was halted. The slug catcher was put out of service to be repaired, and on 9 August 2022, oil production was partially resumed at ~100 thous. bbl per day without the unit. Following the repairs of the slug catcher on 7 November 2022, oil production was restored to full capacity of over 400 thous. bbl per day. Currently, the production facility operates normally. The incident caused no harm to human health or environment.

NCOC’s operational highlights

KMG Kashagan B.V. share buyback

On 15 September 2022, KMG exercised its share buyback right and acquired a 50% stake in KMG Kashagan B.V. from Sovereign Wealth Fund Samruk-Kazyna for a total of USD 3.8 bln.

Having increased its interest in KMG Kashagan B.V. to 100%, KMG improved the consolidated production, EBITDA, net profit and asset portfolio. However, the Company’s debt also grew as it raised funds to finance the share buyback via a bond issue and agreed on a deferred payment with the Fund. The buyback was partially financed by the KMG Kashagan B.V. dividends paid in 2022. In 1H 2023, KMG also plans to repay part of its debt with the KMG Kashagan B.V. dividends.

Outlook for Kashagan

There is a need to build a new slug catcher to replace the temporary configuration of the existing one. The new slug catcher project is currently at the pre-FEED stage. The FID is expected in May 2023, the commissioning – in 4Q 2024.

Projects completed in 2022

The raw gas injection compressor upgrade was completed, and both compressors were commissioned with a confirmed increase in the gas injection rate. Thanks to this project, in December 2022 the facility hit a record in daily oil production: 451 thous. bbl per day (as part of the maximum capacity tests).

Projects in progress

The aim is to increase oil production by ~20—25 thous. bbl per day (2.5–3 thous. tonnes per day) by way of supplying raw gas to the gas processing plant.

- Materials for the pipeline are being delivered from the North Caspian Operating Company N.V. (NCOC) side; general construction is ongoing. The NCOC side is expected to be ready for launch in 4Q 2023.

- The QazaqGaz side will be prepared for commissioning in 1Q 2025.

Projects under consideration

Seeks to increase oil production by ~50 thous. bbl per day (~6.3 thous. tonnes per day) through additional supplies of ~2 bln m3 of raw gas per year to QazaqGaz’ new gas processing plant.

- The project is now at the FEED stage on the NCOC side, with completion expected in 1Q 2023.

- QazaqGaz has not started the gas processing plant FEED. In 2022, it expressed an intent to build a plant with a capacity of 4 rather than 2 bln m3 per year . The current stance of QazaqGaz and the Ministry of National Economy of the Republic of Kazakhstan: the project will be reviewed to increase the plant capacity to 4 bln m3 of raw gas per year (or a step-by-step approach will be applied: 2+2 bln m3 starting 2027).

The aim is to increase oil production by ~210 thous. bbl per day (~26.5 thous. tonnes per day) by drilling new wells and building a new oil treatment plant and to supply ~6 bln m3 of raw gas per year to a third party. Pre-FEED was completed. Due to uncertainties regarding the raw gas recipient, the FEED stage is being postponed.

It is similar to Phase 2B. Additional concept review is ongoing. Progress on this project depends on further implementation of Phase 2B.

The project seeks to commercialise LPG through its fractionation at a third-party plant for further propane and butane exports. Commercial evaluation of third-party bids for the construction of an LPG fractionation plant is in progress. It will be possible to make a FID on the project once its economic feasibility is confirmed and approved.

One of the world’s largest gas and condensate fields.

The Final Production Sharing Agreement (FPSA) in respect of the Karachaganak oil and condensate project was signed by the Republic of Kazakhstan and an international consortium on 18 November 1997. Royal Dutch Shell and Eni are the joint operators of the Karachaganak project (development via Karachaganak Petroleum Operating B.V.).

Interests

The implementation of investment projects to maintain the achieved liquid hydrocarbon production plateau levels.

Operator | Royal Dutch Shell and Eni are the joint operators of the Karachaganak field (Karachaganak Petroleum Operating B.V.)

Karachaganak oil and condensate field is one of the largest oil and condensate fields in the world, located in the West Kazakhstan Region and covering an area of over 280 sq km. The field was discovered in 1979, with pilot development started in 1984.

The Karachaganak project has three core process facilities, comprising a single system of interrelated and interdependent process units within the production process:

- KPC – the Karachaganak Processing Complex, located in the northwestern part of the field and processing liquid hydrocarbons coming from wells as well as feedstock transported from Unit 2 and 3, while also partially preparing gas for export, injection, and internal production needs;

- Unit 2 – a gas treatment unit located in the southeastern part of the field, which separates and reinjects raw gas at high pressure and feeds liquid hydrocarbons to the KPC for stabilisation before shipment for export;

- Unit 3 – a gas treatment unit located in the northeastern part of the field, which separates and partially stabilises liquid hydrocarbons and gas before shipment for export.

In 2022, the field’s operating well stock was 160 wells and 20 injection wells.

Karachaganak Petroleum Operating B.V.’s operational highlights

In 2022, liquid hydrocarbon production from Karachaganak decreased by 2.0% year-on-year to 10.135 thous. tonnes, including KMG’s share of 1.013 thous. tonnes. Gas production grew by 2.4% year-on-year to 19.442 mln m3 in total, with KMG’s share of 1.944 mln m3. One of the key negative drivers for the Karachaganak field in general and KMG in particular was the reduced raw gas intake by Orenburg GPP due to the extension of scheduled preventive maintenance at its process units. The Russian party served a notification on the extension of scheduled preventive maintenance at such units, namely the sulphur recovery and Sulphren off-gas post-treatment unit 1U-350/335, as well as repairs of gas treatment and dehydration units 3U-70 and 3U-370, and Claus units 1U-350/355, U-05/07 and U-04. Gas production increased by 2.4% to 1.944 mln m³ mainly due to the growth in raw gas reinjection at gas treatment unit 2, commissioning of the 4th compressor, and higher gas processing volumes at the Karachaganak Processing Complex.

Taking into account the reduction in raw gas intake by Orenburg GPP, Karachaganak Petroleum Operating B.V. and KazRosGas, it was noted that unstable and limited intake of Karachaganak gas by Orenburg GPP has a negative effect on liquid hydrocarbon production and revenues, as well as KazRosGas’ ability to fulfil its obligations as regards gas supplies to Kazakhstan’s domestic market.

- From 12 September to 6 October, scheduled preventive maintenance works at the Karachaganak field were successfully performed fully in line with the approved schedule and budget.

- In May, the 4th injection compressor was put to service.

- On 16 November, the field hit a new high in daily liquid hydrocarbon production: 34.069 thous. tonnes per day. On 1 December, a record was set in daily raw gas injection: 40.839 mln m3 per day.

- In November 2022, a FID was made on the 6th injection compressor project.

Outlook for Karachaganak

As part of the Karachaganak Expansion Project (KEP1), the 5th and 6th injection compressors are expected to be built and commissioned in 2024 and 2026, respectively, in order to maintain the production plateau at 10–11 mln tonnes per year.

Following Phase 2M of the field development, further support for the production plateau is expected to come from a major production facility expansion, which will be implemented step by step under the Karachaganak Expansion Project (KEP1 A+B). To maintain reservoir pressure and enhance oil recovery, the KEP1 (A+B) project provides for the construction and commissioning of the 5th and 6th injection compressors, raw gas treatment (dehydration) system, the expansion of the system for gathering well products, trunk line network, supporting facilities and other related units. Once the 5th and 6th injection compressors are put into operation, the total gas injection volume will reach ca. 21 bln m3 per year, while gas production at Karachaganak will amount to 31 bln m3 per year, resulting in an aggregate increase in oil production of around 13 mln tonnes over the remaining life of the FPSA.

Building a crossover line with T. Kasymov Oil Pumping Station (potential daily capacity of ca. 4.5 thous. tonnes) will enable Karachaganak Petroleum Operating B.V. to gain access to:

- KazTransOil’s tank farm in case of any CPC failures or incidents;

- alternative export routes (the Baku–Tbilisi–Ceyhan pipeline, the ports of Batumi and Kulevi, exports to China, and to the Novorossiysk port as the Siberian Light grade).

In the mid term, the Karachaganak operator initiated a pre-feasibility study for the ways to add value to (monetise) the produced raw gas and its by-products. Currently, different options for supply volumes and gas processing techniques are being reviewed. The commercial gas is expected to be supplied to the domestic market. Project concept will be decided in 2023.

Oil production at operating assets

With a legacy of more than one hundred years in the oil and gas industry, KMG has a portfolio of producing assets that mainly consists of mature fields. In this regard, the Company’s key priority is to improve production efficiency. The Company is committed to energy saving across operations while also maintaining a strong focus on continuous production process optimisations and improvements and driving higher oil recovery rates.

Today about 85% of total oil production at the Company’s operating assets comes from seven key fields: Uzen and Karamandybas (Ozenmunaigas), Kalamkas and Outlook for Karachaganak Zhetybai (Mangistaumunaigaz), S. Nurzhanov and East Moldabek (Embamunaigas), and Karazhanbas (Karazhanbasmunai).

In 2022, oil and condensate production across KMG Group came in at 22.01 mln tonnes, including 13,761 thous. tonnes of oil produced by operating assets (down 1.4% year-on-year). The decline in oil and condensate production was caused by emergency power cuts by the utility company that services the production facilities at Ozenmunaigas and a natural production decline at some mature fields. That said, the decline in oil production at the operating assets was partly offset by production increases by 3.6% at Mangistaumunaigas and by 2.3% at Embamunaigas.

In the reporting year, Ozenmunaigas, Kazakhturkmunay and Mangistaumunaigaz extended hydrocarbon production contracts and licences at the following fields: Aktas, Tasbolat, Karamandybas, West Tenge, South Zhetybai, South Karatobe, Oimasha, and Alatyube.

In 2022, the total well stock in operation was 16,704 wells, of which 12,696 wells were classified as the current declining well stock. Most of oil and condensate production comes from the current declining well stock.

mln m3

Gas production

Natural and associated gas production increased by 2% to 8,241 mln m3 in 2022. Operating assets produced 2,190 mln m3 (27% of the total), while 6,051 mln m3 (73%) came from megaprojects, with the Tengiz megaproject accounting for the bulk of production.

Gas production values are the actual volume of gas produced, including gas reinjected and own gas needs. Gas reinjection is used to maintain reservoir pressure, which is essential for sustaining high oil production rates.

Commercial gas production in 2022 was 4.529 mln m3, of which 1.516 mln m3 came from operating assets and 3.013 mln m3 from megaprojects. Year-on-year, KMG’s commercial gas production decreased by 96 mln m3, or 2.1% cumulatively.

Along with processing own feedstock, Kazakh Gas Processing Plant (KazGPZ) produces commercial gas using feedstock supplied by KMG’s other operating assets that do not produce commercial gas themselves.