Oil transportation

KMG completed the construction of an oil transportation infrastructure to supply hydrocarbons to export markets. Medium-term priorities:

- increase existing capacity utilisation by making KMG’s oil transportation systems more attractive and competitive;

- develop alternative export routes;

- improve operating-cost control.

The two oil transportation modes at KMG are trunklines and the marine fleet.

Pipeline infrastructure

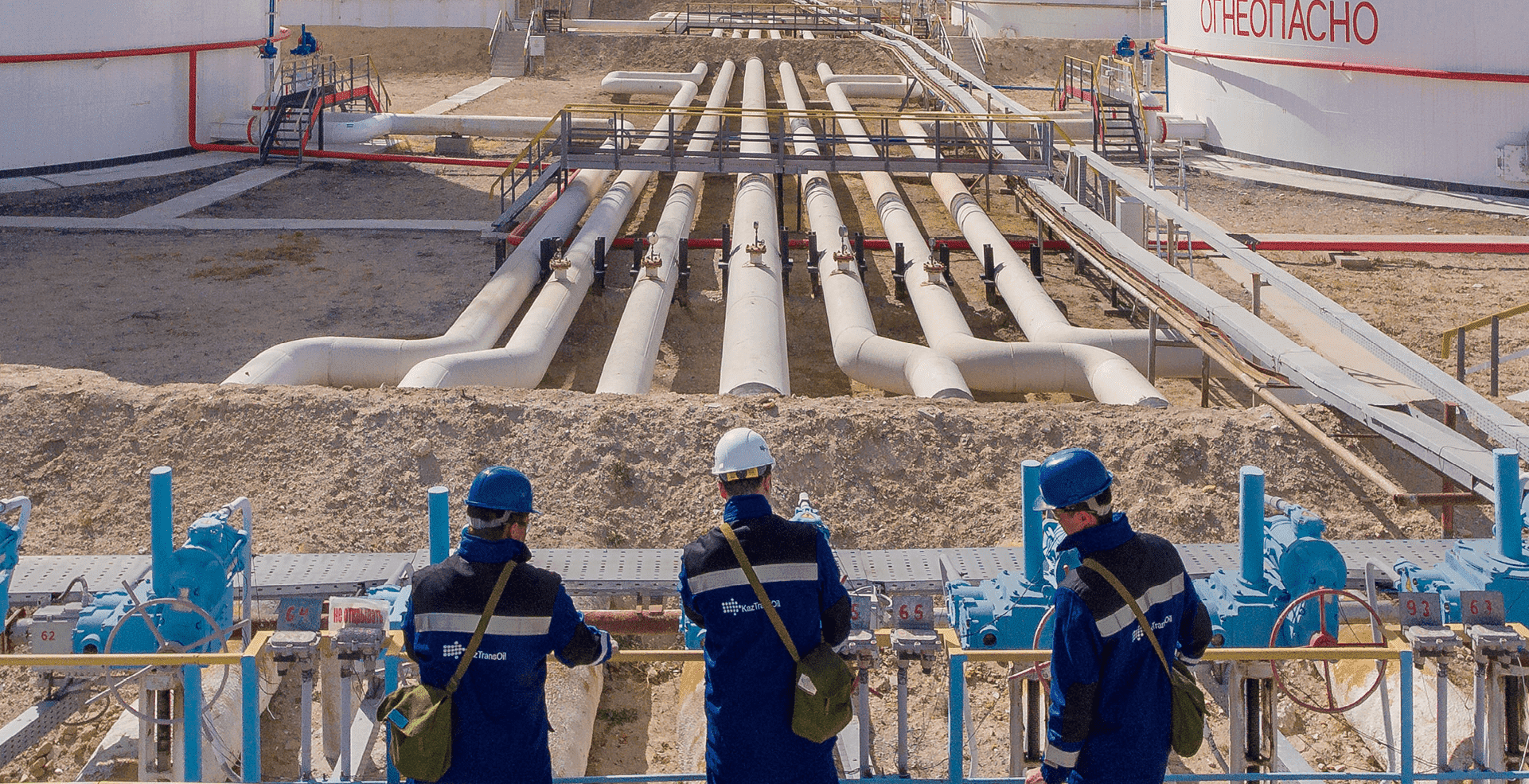

Kazakhstan’s pipeline infrastructure is owned by KazTransOil – the national oil pipeline operator, its two joint ventures (Kazakhstan–China Pipeline and MunayTas North-West Pipeline Company) and Caspian Pipeline Consortium. The existing pipeline infrastructure in Kazakhstan has adequate potential to support increased oil transportation volumes from promising projects.

JSC KazTransOil (KTO) is the national oil pipeline operator of the Republic of Kazakhstan. The company owns an extensive network of oil trunklines with a total length of 5,373 km, to which virtually all oil fields in Kazakhstan are connected. The Company transports oil to Kazakhstan’s four major refineries, pumps oil for export via the Atyrau–Samara pipeline, transships oil to the CPC and Atasu–Alashankou export pipelines, and ships oil to tankers in the Port of Aktau and by rail. Oil transportation via trunklines is supported by 36 oil pumping stations, 67 heaters, and a tank farm for oil storage with a total capacity of 1.4 mln m3. KazTransOil also provides operation and maintenance services for the trunklines of Kazakhstan–China Pipeline, MunayTas North-West Pipeline Company, Karachaganak Petroleum Operating B.V., Caspian Pipeline Consortium-K, and Turgai Petroleum, as well as for the trunk water line of Main Waterline.

Kazakhstan–China Pipeline is the owner of the Atasu–Alashankou (965 km) and Kenkiyak–Kumkol (794 km) oil pipelines. The company transports Kazakhstan’s oil and transit Russian oil to China and to the domestic market.

MunayTas North-West Pipeline Company (MT) is the owner of the 455 km Kenkiyak–Atyrau oil trunkline. In 2018, the company started implementing the Kenkiyak–Atyrau pipeline reverse project to support supplies of West Kazakhstan’s oil to domestic refineries and to compensate production declines in the Aktobe and Kyzylorda Regions, as well as to support exports to China totalling up to 6 mln tonnes per year. The project cost is KZT 30.9 bln. From mid-2021, reverse transportation of up to 6 mln tonnes per year of oil was enabled at the Aman oil pumping station.

Caspian Pipeline Consortium (CPC) is an international oil transportation project involving Russia, Kazakhstan and the world’s leading industry players. It was established for the construction and operation of a 1.510 km trunkline (452 km are within Kazakhstan). The CPC oil pipeline is a priority export route for Kazakhstan’s oil supplies, connecting Kazakhstan’s Tengiz oil field with the Yuzhnaya Ozereyevka oil terminal on the Black Sea (near the Port of Novorossiysk). Oil transportation via the CPC pipeline is supported by 15 oil pumping stations, an oil storage tank farm with a total capacity of 1.3 mln m3 and three single-point moorings.

In 2019, in view of the anticipated increases in oil production from Tengiz and Kashagan, CPC shareholders resolved to launch a debottlenecking project for the pipeline system. The project timeframe is 2019–2023. Pumping capacity is on track to increase to 81.5 mln tonnes/year (including up to 72.5 mln tonnes/year in Kazakhstan).

Trunkline oil transportation

| Company | 2020 | 2021 | 2022 |

|---|---|---|---|

| KazTransOil (100%) | 42,298 | 41,224 | 40,656 |

| export | 16,699 | 14,296 | 12,762 |

| transit | 9,989 | 9,989 | 9,989 |

| domestic market | 15,610 | 16,939 | 17,905 |

| Kazakhstan–China Pipeline (100%) | 15,883 | 17,412 | 19,236 |

| export | 571 | 967 | 1,290 |

| transit | 9,979 | 9,979 | 9,980 |

| domestic market | 5,333 | 6,465 | 7,966 |

| MunayTas (100%) | 3,321 | 4,273 | 5,606 |

| export | 1,595 | 1,572 | 1,188 |

| domestic market | 1,726 | 2,701 | 4,418 |

| Caspian Pipeline Consortium (100%), export | 59,027 | 60,728 | 58,713 |

| 2020 | 2021 | 2022 | |

|---|---|---|---|

| Total: | 22,034 | 21,661 | 22,128 |

| Export destinations | 15,176 | 13,744 | 13,713 |

| "Atyrau - Samara" oil pipeline | 6,508 | 5,074 | 3,842 |

| CPC oil pipeline | 7,898 | 7,888 | 8,864 |

| "Atasu - Alashankou" oil pipeline | 101 | 166 | 223 |

| Port of Aktau | 669 | 616 | 723 |

| Other directions (Railway Batumi, Uzbekistan, Azerbaijan) | 0 | 0 | 60 |

| Domestic destinations | 6,858 | 7,917 | 8,415 |

In 2022, KMG’s share in the consolidated volume of trunkline oil transportation was slightly up by 0.9% to 65,316 thous. tonnes. The increase was due to higher domestic transportation to Kazakhstani refineries in order to ensure necessary refining volumes in the domestic market. At the same time, oil exports decreased due to the natural decline in oil production at mature fields, and due to redistribution of oil by shippers to the domestic market and lower production at Kashagan due to repairs. Note that the Caspian Pipeline Consortium (CPC) saw a 3.3% decline in transportation volumes in the reporting year. This decline mainly ensues from repairs at Kashagan and at single point moorings of the marine terminal operated by CTC. Currently, CTC operates normally.

Oil transportation using KazTransOil trunklines is expected to decline by 568 thous. tonnes year-on-year to 40,656 thous. tonnes.

Lower oil volumes fed to KazTransOil trunklines are mainly due to a decrease in production and delivery (Ozenmunaigas, CNPC International Aktobe Petroleum, oil producers from the Kumkol group of fields). Besides, a number of oil companies redirected their products to Kazakhstan bypassing KazTransOil trunklines.

A year-on-year increase in KCP transportation is due to more oil exported to China and domestic refineries.

A year-on-year increase in domestic oil transportation by MunayTas is attributable to more volumes of reverse transportation to utilise Pavlodar and Shymkent refineries.

A year-on-year decline in exports is associated with a focus on domestic supplies to ensure refinery utilisation.

Tariffs for trunkline oil transportation

The tariffs for crude oil transportation to Kazakhstan’s domestic market are regulated by the government.

According to Law of the Republic of Kazakhstan No. 204-VI on Natural Monopolies dated 27 December 2018, oil transportation services to support transit via the Republic of Kazakhstan and exports outside the Republic of Kazakhstan are beyond the scope of natural monopolies.

In 2022, the Company implemented the following key energy efficiency initiatives:

- replaced five pumps at Pavlodar and B. Djumangaliev head oil pumping stations, as well as Ekibastuz and Stepnoye oil pumping stations with more efficient ones. This delivered an 11% and a 16% decrease in electricity consumption per unit of oil pumped through Pavlodar–Atasu and Djumangaliev–Atasu sections, respectively, with total savings estimated at 2,465,000 kWh per year;

- installed a variable-frequency drive at the Uzen head oil pumping station, with electricity consumption per unit of oil pumped through the Uzen–Atyrau section down by 11% and total savings estimated at 2,071,000 kWh per year;

- optimised the temperature of hot pumping at the Atyrau–Samara pipeline by improving the rheological properties of oil blend in summer (redistributing Mangyshlak oil). This enabled the switch off of heaters from June to September 2022 and achieve the savings of ca. 4,896,585 m3per year;

- as part of the HAZOP study upgraded energy supply of oil heating facilities and replaced electrical drives protecting heaters against emergencies at the A. Kultumieva oil pumping station and Opornaya high-speed pipeline heater.

In 2023, the Company plans to implement the following initiatives:

- Upgrade a booster pumping station at Zhetybai oil pumping station to save an estimated 2,032,000 kWh per year;

- upgrade linear control and monitoring stations and cathodic protection means, reconstruct electricity supply systems at the Pavlodar–Shymkent trunkline (1,499.9–1,572.1 km), introduce renewable energy sources.

KCP participants plan to build the Aralsk oil pumping station to increase the capacity of the Kenkiyak–Kumkol trunkline to 15 mln tonnes per year. The plans require the participants’ consent and are being currently discussed.

Trans-Caspian oil transportation (overseas exports via the Caspian Sea using the Baku–Tbilisi–Ceyhan pipeline) is under consideration. The Company expects to supply 1.5 mln tonnes of Tengizchevroil’s oil per year from 2023.

Events related to some CPC-operated single point moorings (SPMs) going out of service in 2022

In 2022, the CPC marine terminal repeatedly faced restrictions on the operation of single point moorings (SPMs). Repairs have been completed at three of CPC’s SPMs.

Despite the emergencies that affected the CPC pipeline from time to time in 2022, oil exports via the pipeline was down by only 3% and remained largely stable.

Diversification of oil transportation routes

In furtherance of the order from the Republic of Kazakhstan President to diversify hydrocarbon exports corridors, KMG keeps looking for alternative overseas transportation routes for domestic oil.

Oil exports to Azerbaijan through the Port of Aktau

In November 2022, KMG signed an oil transit agreement with the State Oil Company of the Republic of Azerbaijan (SOCAR) to transport 1.5 mln tonnes of Kazakhstani oil per year via the Aktau–Baku–Ceyhan route over the next five years.

Transportation of 1.5 mln tonnes of oil via the Aktau–Baku–Ceyhan route will enable Kazakhstani producers to assess its efficiency, among other things, based on the data from the BTC oil quality bank and the effect of Kazakhstani oil on the economics of BTC blend.

That said, KMG will continue negotiations with Azerbaijan to increase oil transit via the Baku–Ceyhan pipeline and other potential routes from Baku (railroad transportation to Batumi, Baku–Supsa pipeline, and supplies to Azerbaijan refineries).

Tengiz–Batumi railway supplies

In 2022, a total of 243 thous. tonnes of oil was shipped from the Tengiz field via the Tengiz–Samur–Baku–Batumi railway route with transit through Russia.

Transportation to China

In August–November 2022, KMG held several rounds of negotiations with CNPC on increasing oil supplies to China and extending the pipeline.

Options to increase capacity in order to boost oil exports from Atyrau to China are on the table:

- ramp-up of Atyrau-Kenkiyak to 12 mln tonnes/year (+2 oil pumping stations) and Kenkiyak–Kumkol to 15 mln tonnes/year (+1 oil pumping station).

The relevant negotiations between parties are ongoing.

Oil transportation by sea

Transportation assets

Engaged in:

- oil transportation in the Caspian Sea and open seas;

- dry and container cargo transportation;

- provision of fleet support services for offshore operations.

Its assets include:

- merchant fleet – oil tankers (Astana, Almaty and Aktau, each with a deadweight of 12,000 tonnes) and Aframax oil tankers (Alatau and Altai, each with a deadweight of 115,000 tonnes);

- dry cargo fleet (5,000-tonne Beket Ata and Turkestan vessels);

- marine support fleet: 4 barge platforms of KMG series with a capacity of 3,600 tonnes each;

- container fleet: Barys and Sunkar with a capacity of 5,200 tonnes or 350 TEUs each,

- Berkut, an MCV-class vessel with capacity of 5,200 tonnes, and 3 tugboats – Talas, Emba and Irgiz with a bollard pull of 40 tonnes-force each;

The main routes for oil transportation by sea go across:

- Caspian Sea;

- Black Sea and Mediterranean Sea.

NMSC Kazmortransflot (KMTF) is the National Sea Carrier

Performance highlights

In 2022, total sea transportation shrank by 512 thous. tonnes year-on-year to 9,343 thous. tonnes due to less oil shipped by KazMunayGas Trading from Petromidia Refinery.

In September 2022, the auxiliary multifunctional vessel Sunkar was reequipped to transport containers along the Aktau–Baku–Aktau feeder line.

In November 2022, Berkut conversion into a container vessel started.

In December 2022, KMG’s Investment Committee approved the purchase of two oil tankers with a deadweight of 8,000 tonnes each.